does cash app report personal accounts to irs

Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold.

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Cash App SupportTax Reporting for Cash App.

. Thats because the IRS will be keeping a watchful eye on cash app transactions for small businesses. Log in to your Cash App Dashboard on web to download your forms. What does this mean say I received 50k on cash app for my personal account do I got to pay taxes on that money and will I get a tax for because what if u dont have history of all transactions.

Cash App Support Tax Reporting for Cash App. This is far below the previous threshold of 20K. The American Rescue Plan includes language for third party payment networks to change the way.

So what matters for taxes is how you can to posses this money. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax would be placed. When Dont the Rules to Report Cash App Payments Apply.

E-filing is free quick and secure. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others. For any additional tax information please reach out to a tax professional or visit the IRS website.

This is far below the previous threshold of 20K. They dont affect personal transactions. Keep detailed records of your own to compare to the information you receive on Form 1099-K.

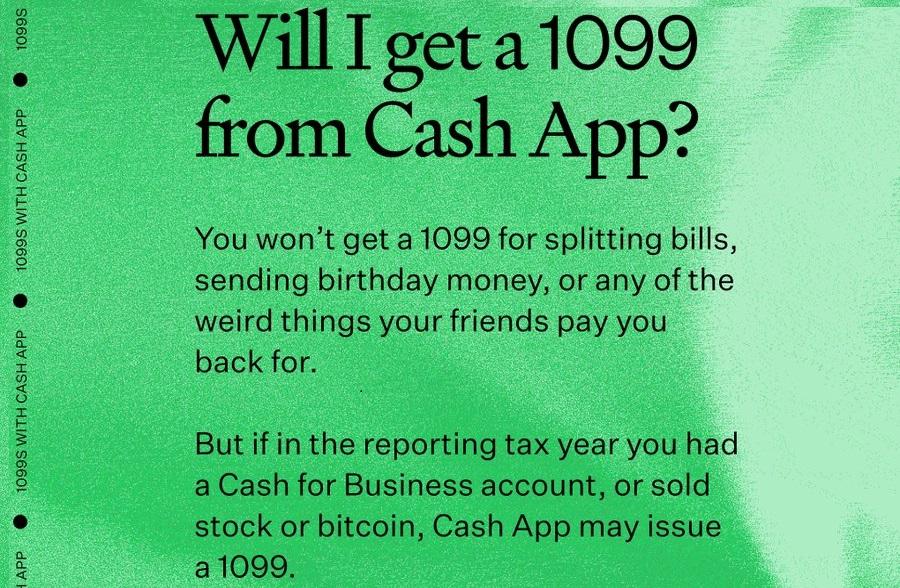

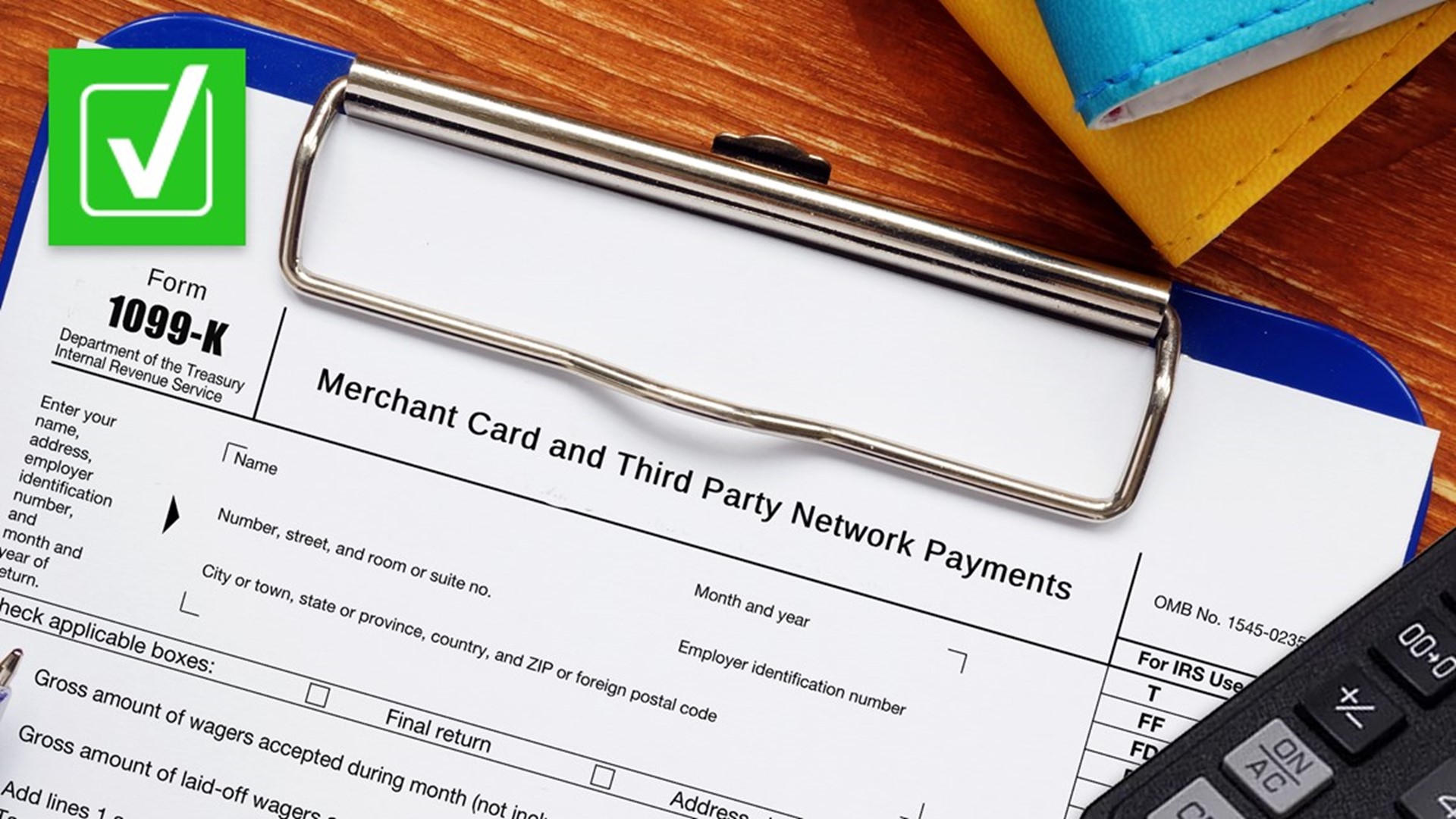

A copy of the 1099-K will be sent to the IRS. If you have a standard non-business Cash App account you dont need to worry about Form 1099-K. Open separate P2P accounts for business and personal use to make reporting easier.

However the American Rescue Plan made changes to these regulations. As part of the American Rescue Plan Act cash apps will now report commercial income over 600. Preparing your tax return with Cash App Taxes is trouble-free and straightforward.

So if I have a friend who for example sends me 1000 what would happen tax wise. Nothing to do with the transfer method currency etc. With more people using cash apps the IRS now has the ability to cross-verify reported income through third-party payment apps.

Be ready to provide your taxpayer identification number eg Employer Identification Number to the cash app so they can report it on Form 1099-K. Log in to your Cash App Dashboard on web to download your forms. Soon cash app earners will need to report to the IRS.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. 1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS. The software asks a few questions about you your.

However the American Rescue Plan made changes to these regulations. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. For any additional tax information please reach out to a tax professional or visit the IRS website.

This new 600 reporting requirement does not apply to personal Cash App accounts. Under the original IRS reporting requirements people are already supposed to. Certain Cash App accounts will receive tax forms for the 2021 tax year.

Certain Cash App accounts will receive tax forms for the 2018 tax year. For any additional tax information please reach out to a tax professional or visit the IRS website. Op 1 yr.

You need to pay taxes on your income. Filers will receive an electronic acknowledgement of each form they file. So now apps like Cash App will notify the IRS when transactions get up to 600.

Tax Reporting for Cash App. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. Only customers with a Cash for Business account will have their transactions reported to the IRSif their transaction activity meets reporting thresholds.

Cash App wont report any of your personal transactions to the IRS. Effective January 1 2022 combined earnings of 600 or more will now be reported to the IRS pursuant to a provision in the 2021 American Rescue Plan that was passed in March 2021 which directs third-party payment. A copy of the 1099-K will be sent to the IRS.

Taxes are based on the source of the income not on the account they are received into. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. If you are someone who utilizes the convenience of receiving money through digital apps like PayPal Zelle Cash App or Venmo this information is for you.

Likewise people ask does Cashapp report to IRS. Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold. Now cash apps are required to report payments totaling more than 600 for goods and services.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. If you arent using cash apps for business transactions you can probably ignore the new regulations. A new law requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS.

Now cash apps are required to report payments totaling more than 600 for goods and services.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Mosheh Oinounou On Instagram A New Provision In The 3 5 Trillion Budget Bill Requiring Banks And Cash Apps Like Venm Budgeting Accounting Information Venmo

![]()

Tax Reporting With Cash For Business

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Irs Tax Refund Here S What You Need To Know If You Use A Payment App For Your Refunds Marca

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

Venmo Paypal Cash App Zelle Must Now Report Payments Of 600 Or More To Irs Spectacular Magazine

Changes To Cash App Reporting Threshold Paypal Venmo More

How To Log Out My Cash App From All Devices In 2022 Banking App App Home Screen App

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Falcon Expenses Cash Expense Capture With Receipt Business Expense Business Expense Tracker Small Business Accounting

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

Irs Has New Ways Of Taxing Cash App Transactions

Does Cash App Report To The Irs

Does Venmo Report To The Irs Irs Venmo Finance Tips

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com